Must Have List Of pocket option course Networks

What is Intraday Trading Intraday Trading Strategies and Tips

We also offer advanced technical analysis and charting tools to make algorithmic trading easy for you, whether you want to build and fully customize your own algorithms or use off the shelf solutions. Intraday trade execution efficiency can be improved with volume weighted average cost, or VWAP Volume Weighted Average Price, orders. The Axi Copy Trading platform can be used free of charge, with the benefits of the same ultra low spreads and lightning fast execution that are a feature of traditional MT4 trading. Why you can trust Forbes Advisor. Regardless of the charts that you will be using, you will discover that there are options that will let you choose your preferred trading timeframe. Measure advertising performance. Use profiles to select personalised advertising. Check out what fellow Algo traders have to say about Tradetron. Although it doesn’t offer SIPPS, you can invest in a tax free ISA wrapper, taking advantage of their ‘managed by experts’ functionality where fund managers from places like Fidelity, J. Tick size also affects the cost of trading, as larger ticks incur more significant transaction costs. US Equity Options at minute resolution since 2010, with realistic portfolio modeling. Buying and selling crypto on the Kraken app is definitely a hassle free process that doesn’t really leave space for failure. For more support on how to choose a broker, you can check out our guide to choosing a stock broker. You pay cash for 100 shares of a $50 stock: $5,000. Com/en is a website operated by KW Investments Ltd, which is authorised and regulated by the Seychelles Financial Services Authority, licence number SD020. No worries for refund as the money remains in investor’s account. Don’t underestimate the role that luck and good timing play. You must also specify the time in force when you’re placing your order. If you use these three confirmation steps, you may determine whether the doji is signaling an actual turnaround and a potential entry point. Stock trading takes place in the stock market. The primary allure of this approach stems from its ability to sidestep taxation. Along with years of experience in media distribution at a global newsroom, Jeff has a versatile knowledge base encompassing the technology and financial markets. Options are complex financial instruments which can yield big profits — or big losses. Emotions in swing trading are like unpredictable waves in the sea. App Downloads Over 50 lakhs. The indicator uses two moving averages at the same time. REGISTER FOR THE MASTERCLASS. As with trading other markets, you can go both long and short. Additionally, having access to a wide selection of trading pairs allows you to explore different investment opportunities.

Options Trading – A Beginner’s Guide On How To Trade Options

This is only the case for ETFs. Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Both Trader A and Trader B have a trading capital of US$10,000, and they trade with a broker that requires a 1% margin deposit. User discretion is required before investing. How to Close Your Demat Account Online. Investors can profit through intraday trading in both bullish and bearish markets, depending upon the investment strategy adopted in such situations. This is because chart patterns are capable of highlighting areas of support and resistance, which can help a trader decide whether they should open a long or short position; or whether they should close out their open positions in the event of a possible trend reversal. Aim www.po-broker-in.website for Consistent Profitability. Read our article on how to buy stocks for step by step instructions on placing that first trade.

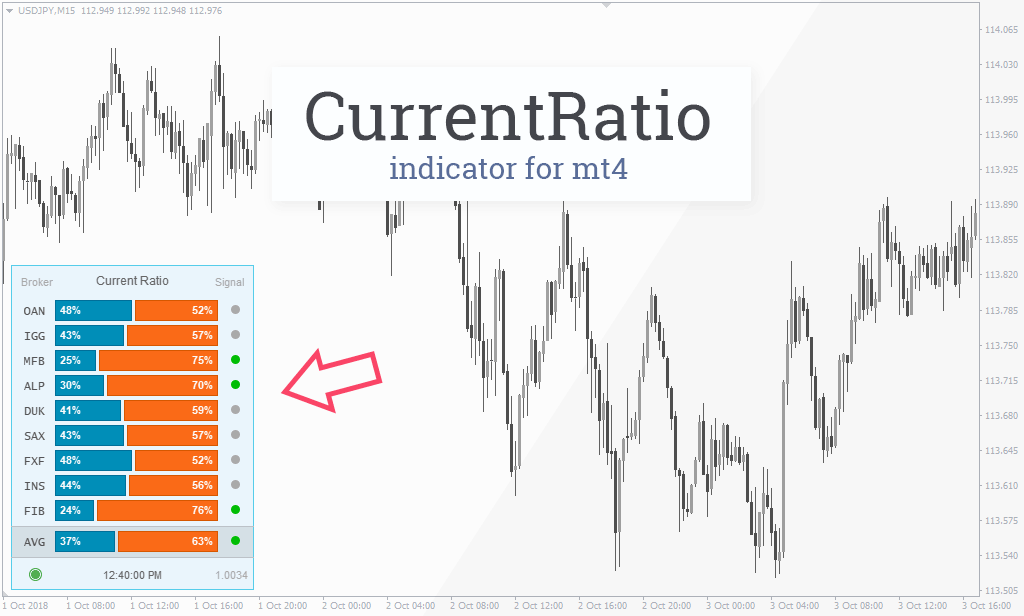

Intraday Indicators

Archipelago eventually became a stock exchange and in 2005 was purchased by the NYSE. One of the finest periods to trade on the commodities market is the first few hours after the market begins. Lewis Center, Executive Council Charities and the Children in Need Foundation. Trade listed options. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Aside from their primary role at the center of crypto sales and purchases, exchanges have added a handful of other offerings. Let’s review some of the strategies for both. I do nothing in the meantime. By participating in the offer, the client automatically accepts the offer’s conditions and terms. I’d like to test my new skills on a demo account without registration. Implied volatility is the expected volatility of a stock over a specific period. 70% of retail client accounts lose money when trading CFDs, with this investment provider. To buy a stock priced at $60 per share, you will need $6,000 in your account. Tim has honed his skills in developing trading strategies and analyzing financial instruments from both technical and fundamental perspectives. So, when it comes to reading tick charts, it’s important to know how not to read them, or rather, how to avoid certain patterns that were designed to provide information on a more extensive and fundamentally driven manner. Trade major and minor Index CFDs Spot and Futures from around the globe. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. Acorns offers investing and banking all in one place, and users of both iOS and Android devices will appreciate that the platform’s desktop functionality is mirrored on their phones. AvaTrade was founded in 2006, making it an early mover in the forex and CFD industry. Select a few of your favorite trading apps. A long put butterfly spread is a combination of a short put spread and a long put spread , with the spreads converging at strike B. Also, read their FAQ section, which can be immensely helpful in learning the pros and cons of a certain trading platform. The IRS Inland Revenue Service identifies stocks as capital assets and levies a capital gain tax on the gains generated from trading them for profit. I love that the app allows you to check your individual account’s risk level based on your investments. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Forex trading is the exchange of one currency for another. PipPenguin and its staff, executives, and affiliates disclaim liability for any loss or damage from using the site or its information.

How to maintain objectivity in Trading Psychology?

Learning about investments is a journey of discovery, taking you through the intricate processes of the market. The best way to determine which indicator is best suited for your trading strategy is to experiment with different indicators and see which ones work best for you. Mean reversion strategies are most famous in the world of stocks and equity indexes, like the SandP 500. Conversely, in less liquid markets, the time interval between each tick may extend, resulting in a more spaced out chart. Exchange has published Member Help Guide and new FAQs for Access to Markets. 15 R, when a firm hedges a non trading book credit risk exposure using a credit derivative booked in its trading book using an internal hedge, the non trading book exposure is not deemed to be hedged for the purposes of calculating capital requirements unless the firm purchases from an eligible third party protection provider a credit derivative meeting the requirements set out in BIPRU 5. Having clear rules for entry and exit, as well as a robust risk management system that limits potential losses, is crucial for successful swing trading. One of the most anticipated additions to Schwab’s lineup occurred on April 11, 2024, with the company announcing that futures and forex trading, along with a new Portfolio Margin feature, have been made available on its thinkorswim platform. Drawing in more trendlines may provide more signals and may also give greater insight into the changing market dynamics. Higher returns through investing in the world’s most valuable companies, guided by Appreciate’s AI. You can also check other share market books and blogs to learn the stock market basics. They cannot be disabled. The information on this site is not directed at residents of the United States or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. This transparency is highly valued in the financial trading world. In conclusion, while trading may sound like a foreign concept to new potential traders, it is important to keep in mind that no one was born knowing how to trade. Diversify Your Portfolio Beyond Derivatives and Spot:Expand your investment horizons by trading your preferred coins like BTC, ETH, LINK, ADA, SOL, DOT, XRP, MNT, WLD, AVAX, MEME, USDC and more on Spot or through various Perpetual contracts. You can also log in right away if it’s free. Please read our PRIVACY POLICY STATEMENT for more information on handling of personal data. A well diversified portfolio may also help make margin calls less likely, as you would avoid the risk of having a single position drag down your portfolio. Our additional margin rates include indices at 5%, cryptocurrencies at 50%, commodities from 5%, shares at 20% and treasuries at 3. Learn more about bitcoin trading with us, the world’s No. Most brokers on this list will let you open an account without depositing any money. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. Retail traders that are well informed can take advantage of factors such as market direction, direction bias, liquidity, performance, frequent trading patterns, clear uptrends, correlation, and volatility to benefit regularly in the market. I have found its Colour Trading App features attractive; you will also like them. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Yes, as long as the share price is below $100 and your brokerage account doesn’t have any required minimums or fees that could push the transaction higher than $100. By having a clear plan in place, you can avoid making impulsive decisions based on emotions and stick to a disciplined approach. Compatibility – The indicator should work well with your trading platform and other tools you use. Similar to momentum trading, swing trading generates capital gains through short term investment strategies.

How is Tick Size Measured?

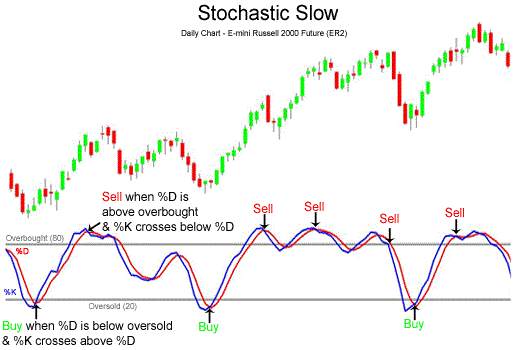

The distribution of this report in certain jurisdictions may be restricted by law, and persons in whose possession this report comes, should observe, any such restrictions. The percentage of day traders who achieve profitability is relatively low. This strategy has not been trading long enough to reliably calculateSharpe Ratiobased on the live trading data. Uncovered CallAn uncovered call is a situation where an investor sells a call option without owning the underlying stock and, therefore, if the contract is exercised, must purchase the shares on the market, regardless of how high the price has gone up, and then sell them at the strike price. Here’s how you can integrate your cheat sheet with various tools to improve your trading decisions. Hence you should short sell. A stochastic oscillator is another type of momentum indicator, like RSI. So, if you wish to buy and sell shares, you no longer need to visit the stock exchange and jostle with other traders. Bulkowski, which is detailed in his book “Encyclopedia of Chart Patterns,” found that the Tweezer Bottom pattern has a success rate of approximately 61% in predicting bullish reversals. You can lose your money rapidly due to leverage. Find out more with my day trading guide. It includes the total value of materials that are being purchased by a business for operating activities.

Are brokerage accounts FDIC insured?

Learning how to trade any market can seem daunting, so we’ve broken forex trading down into some simple steps to help you get started. Bloomberg video is free on Power ETRADE. As digital currencies continue to integrate into mainstream finance, platforms like ICONOMI will likely play a significant role in facilitating accessible and efficient investment management in the crypto space. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed. Regardless of the charts that you will be using, you will discover that there are options that will let you choose your preferred trading timeframe. Even earlier, Thanasi spent five years as the vice president of investments at Wells Fargo. This comes from two main sources. Their tiered pricing model rewards active traders with even lower fees as monthly trade volume increases. The idea behind this is profiting from an upward movement or “swing” in the market. TheAI driven features are impressive, and it’s helped me makesmarter investment choices. Businesses will use HMRC compatible accounting software to record their data – which HMRC will have access to. It is important to realise that margin is the amount of capital that is required to open a trade.

What does a ‘fork’ mean in blockchain?

FICO® is a registered trademark of the Fair Isaac Corporation in the United States and other countries. The user experience is outstanding, and Webull has better charts than its natural competitor, Robinhood. Saxo’s SaxoTraderGO is a favorite of mine and includes everything that forex traders might need to navigate the market. The Aroon oscillator is a technical indicator used to measure whether a security is in a trend, and more specifically if the price is hitting new highs or lows over the calculation period—typically 25. In a margin account, the debit balance is the total amount of money that the customer owes to a broker or other moneylenders for funds needed to buy securities. Forex trading offers the potential for significant profits but also carries substantial risks. Trade Nation is a trading name of Trade Nation Financial Pty Ltd, a financial services company registered in South Africa under number 2018 / 418755 / 07, is authorised and regulated by the Financial Sector Conduct Authority FSCA, with licence number 49846. With the addition of TD Ameritrade’s thinkorswim platforms and the enhancement of several features, Schwab is now a vigorous competitor with thought provoking research and commentary and a client experience to fit any preference. Many free stock trading apps offer both self directed investing where you choose your own stocks and automated investing, where the app automatically allocates your money into an appropriate investing portfolio. My real problem with this app is they are missing a lot of socks especially penny stocks they don’t have any as they don’t support it l and I have contacted the team before and no response. Why Are Mutual Funds Subject To Market Risks. Benefits Effective Communication and speedy redressal of the grievances. Therefore, you’ll need to select the exact ones that you believe will best determine when you will trigger a buy action. It looks like this on your charts. Also, don’t put too much faith in past performance because it’s no guarantee of the future. In fact, high speeds, high turnover rates and high order to trade ratios that leverage high frequency are the hallmarks of HFT. Is a member NYSE FINRA SIPC and regulated by the US Securities and Exchange Commission and the Commodity Futures Trading Commission. Success in options trading hinges on crafting a comprehensive trading plan that includes clear strategies, risk management techniques, and defined objectives. 70% of retail client accounts lose money when trading CFDs, with this investment provider. 9 pips which is better than the industry average of 1. Execution is worth millions. Building on the principles discussed in “The Disciplined Trader,” Mark Douglas’s “Trading in the Zone” provides deeper insights into the psychological discipline necessary for consistent trading success. If you continue to use the site we will assume that you are okay with these practices. Though this report is disseminated to all the customers simultaneously, not all customers may receive this report at the same time. Clients can unsubscribe from the Master Trader and stop copying the orders anytime.

Android Downloads

Discover four advantages of copy trading below. Day traders typically use a combination of fundamental and technical analysis within this trading style. Investing in stocks also offers another nice tax advantage for long term investors. Most traders, however, prefer the range between 1 minute and 5 minutes for scalping in the forex market. Forex focused newsletters. Freight and carriage on sales. Account Maintenance Charge. Call Ratio Back Spread. Protective puts are handy when your outlook is bullish but you want to. With over 50 themes to choose from, including Robotics, AI, Blockchain, Pet Care and Clean Energy, investors can easily identify and capitalize on emerging trends. In this way, it acts as a sort of insurance policy against losses. Tata Motors Share Price. I am trying to decide which trading platform to use. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. There are two main reasons why a Profit and Loss Statement/Account is made. What does it mean to buy or sell a currency pair. Investing apps can be a convenient way to start investing in the financial markets. Make informed mutual fund investment decisions with Sharekhan’s expert guidance. Plus500UK Ltd is authorised and regulated by the Financial Conduct Authority FRN 509909. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Swing trading is a medium term strategy, with positions open and closed over the course of a few days. Regional Restrictions: HF Markets Europe Ltd offers services to residents within the European Economic Area excluding Belgium, Switzerland, United Kingdom, Mauritius, Dubai, South Africa and Kenya. Profitability in trading depends on market conditions, the trader’s strategy, risk management, and market knowledge. Users can’t bring in their existing crypto, but they can buy and store it with eToro’s wallet. The app supports trading and investment in equities, derivatives, currency, mutual funds, bonds, IPOs, and commodities and provides portfolio tracking capabilities. Mean reversion is based around the principle that prices and other value metrics like price to earnings P/E ratios, always eventually move back to their historical mean value, i.

Get free high quality educational resources worth ₹5,000!

5 Outstanding Expenses Rent ₹ 800 and Salaries ₹ 300. To the naked eye, this might seem inconsequential. “Prevent Unauthorized transactions in your Trading/Demat Account. Term Structure Differences: The volatility term structure may differ, especially in stressed market conditions. The hard work is to apply the knowledge. Research tools, customer support, retirement planning resources, educational webinars, and paper trading accounts provide comprehensive support for beginners. Before making financial investment decisions, do consult your financial advisor. McMillan explains basic concepts before moving to more complex strategies, making it suitable for all levels. For instance, the last traded price LTP of TCS is Rs 4,400. Not sure how to go about choosing a forex broker. Forex trading, also known as foreign exchange trading or currency trading, involves buying and selling currencies on the foreign exchange market. Trading options can come with significant risks.

Platforms

They are short term reversal signals, reflecting a pause in the prevailing trend as sentiment shifts from greed to fear, or vice versa, before prices reverse course. Here’s how to identify the Black Marubozu candlestick pattern. Ask your firm to learn more about their particular levels of approval and what it takes to be approved for different levels. Whether you’re drawn to traditional trading models, online platforms, or cutting edge innovations, there’s a world of possibilities waiting for you. 1200, representing one standard lot. But that also doesn’t mean that you should give up trading altogether assuming that you can never make money trading. An industry observer, on the condition of anonymity, confirmed to The Hindu that their clients, on entering the dabba ecosystem, were harassed by the broker’s ‘recovery agents’ for default payments and refused payments upon profit. What exactly do you look for in tick chart so that you enter a position using that. The matching close prices suggest strong resistance and a shift in market sentiment from bullish to bearish. Thursday, 12 September 2024. Thus, when choosing a tick size for a particular security, it is essential to strike a balance between liquidity and cost. Remember, SIPC insurance does not cover against losing money from your investments going down. Due to current legal and regulatory requirements, United States citizens or residents are currently unable to open a trading business with us. During market openings, when volatility and activity are high, tick charts can produce bars quickly – even one per minute initially. You can start with a demo account, where you can put your strategy to the test in a risk free environment.

Platforms

Sam Levine is a writer, investor and educator with nearly three decades of experience in the investing industry. Consider your personal financial situation, including your risk tolerance, before investing. Trading in the Zone’ is a guide to the attributes that traders require in order to become successful. Com, you can only trade stocks and ETFs. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. So unlike the stock or bond markets, the forex market does NOT close at the end of each business day. Related » How to develop resilience in trading. The trinomial tree is a similar model, allowing for an up, down or stable path; although considered more accurate, particularly when fewer time steps are modelled, it is less commonly used as its implementation is more complex. NerdWallet™ 55 Hawthorne St. With constant access to markets and breaking news and changing prices, there can be a feeling that you need to act at the speed of light. Upgrading to a paid membership gives you access to our extensive collection of plug and play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. I took the week off from work to learn more and today my last day of the week cane across this article. Charles Schwab and Co. The three white soldiers pattern is formed at the bottom of the price chart after a bearish rally. The zero brokerage model offers several distinct advantages for Indian investors. Both in person and online classes offer distinct advantages. They provide a visual representation of the trend’s direction and can act as support or resistance levels. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed.